New Bill Requires Tax ID for Bank Account Access in Nigeria

New Bill Requires Tax ID for Bank Account Access in Nigeria

A proposed bill in Nigeria aims to mandate that individuals involved in banking, insurance, stock broking, and other financial services must provide a Tax Identification Number (TIN) to open new accounts or maintain existing ones.

Entitled “A Bill for an Act to Provide for the Assessment, Collection of, and Accounting for Revenue Accruing to the Federation, Federal, States, and Local Governments; Prescribe the Powers and Functions of Tax Authorities, and for Related Matters,” the legislation seeks to boost tax compliance and enhance revenue collection across the country.

According to the bill, which was sourced from the National Assembly on October 4, 2024, “Any person engaged in banking, insurance, stock-broking, or other financial services in Nigeria shall be required to present a tax ID as a condition for opening a new account or managing an existing one.”

This initiative is part of a larger strategy to ensure that all individuals and organizations involved in financial transactions are appropriately registered for tax purposes.

Additionally, the bill specifies that non-resident individuals supplying taxable goods or services in Nigeria, or earning income from the country, must also register for tax and obtain a TIN. However, non-residents receiving only passive income from investments will not need to register, although they are still required to provide pertinent information as specified by tax authorities.

The proposed legislation further grants tax authorities the power to automatically register individuals who are obligated to obtain a TIN but have not done so. In such instances, the authorities must notify the individual about their registration and TIN issuance.

Non-compliance with these regulations may lead to administrative penalties. Specifically, individuals who fail to register for tax will incur a fine of N50,000 for the first month of non-compliance, followed by N25,000 for each additional month.

TRENDING SONGS

Nigerian Officials Allegedly Pocket N4–6B Weekly Through Smuggling Cartels at Seme–Badagry Border

Nigerian Officials Allegedly Pocket N4–6B Weekly Through Smuggling Cartels at Seme–Badagry Border

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

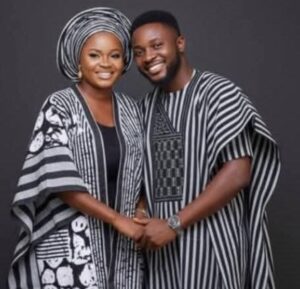

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Share this post with your friends on ![]()