Borrowing Is Not a Crime — Presidency Justifies Debt Strategy

Borrowing Is Not a Crime — Presidency Justifies Debt Strategy

The Presidency has reiterated that borrowing remains a necessary instrument for national development, emphasizing that responsible debt usage should not be seen as a negative practice.

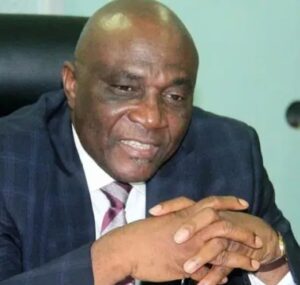

This stance was articulated during a media briefing in Lagos, where key government officials discussed the economic progress made under President Bola Tinubu’s administration and outlined its forward-looking agenda.

Just last week, President Tinubu submitted a proposal to the National Assembly seeking approval for additional external and domestic loans amounting to N34.15 trillion. Addressing concerns over Nigeria’s rising debt levels, Presidential Adviser on Information and Strategy, Mr. Bayo Onanuga, maintained that borrowing is common among even the most advanced economies.

“It’s misleading to treat borrowing as inherently wrong,” Onanuga said. “Countries like the United States and the United Kingdom borrow far beyond their GDP. The real concern isn’t the act of borrowing, but how the funds are utilized. We must face reality — Nigeria has limited financial capacity compared to its large population. Our national budget is smaller than that of South Africa. Without loans, we can’t meet our development goals.”

He pointed out that the Tinubu administration has already made headway with economic reforms despite grappling with significant inherited challenges.

Reflecting on the administration’s first year in office, Onanuga acknowledged the turbulence caused by inflation, currency volatility, and long-standing structural issues. However, he noted that Nigeria’s economic indicators have improved steadily.

“There’s been a marked turnaround in the economy. Global financial institutions like the IMF and World Bank have taken note,” he added. “The Nigerian Stock Exchange’s All Share Index has jumped from 50,000 in 2023 to over 110,000 in 2025. Our foreign reserves now stand at $21 billion, and debt servicing costs have dropped from 97% to below 60% of government revenue — allowing more room for social investments.”

He also highlighted ongoing infrastructure and social programs, financed through public-private partnerships and alternative funding mechanisms like Infraco, tax incentives, and co-investment with state governments.

“The government is focused on inclusive growth. Over 600,000 students have already accessed loans through the NELFUND program. We’re also investing in vocational training and financial support for SMEs to strengthen Nigeria’s industrial capacity.”

Onanuga further addressed the tough economic conditions many Nigerians face and outlined efforts to provide relief and stabilize the economy.

“We know these are difficult times. The government is responding — from securing bulk medicine supplies through a medical pool to supporting agriculture directly to curb food inflation. The adoption of Compressed Natural Gas (CNG) is also helping transport workers significantly cut fuel costs. Many drivers are now earning more simply by spending less on fuel,” he explained.

“In addition, the President approved a temporary six-month suspension of rice import duties. This was a strategic move to reduce food prices and combat artificial scarcity driven by hoarding.”

He concluded by urging Nigerians to adopt a more realistic view of the nation’s fiscal capabilities.

“Nigeria is not as wealthy as many believe. We’re a large country with limited resources and growing demands. It’s time to align our expectations with our actual capacity.”

Also speaking at the event, Mr. Sunday Dare, Special Adviser on Public Communication, stressed that borrowing becomes transformational when applied wisely.

“We can’t build key infrastructure like highways connecting Lagos to Calabar or Sokoto to Bida without borrowing,” Dare noted. “Such projects have the potential to energize entire regions. The issue isn’t debt — it’s misuse. When managed correctly, borrowing can be a powerful driver of growth and progress.”

TRENDING SONGS

WOMAN REVEALS HOW PATIENCE AND TIMING HELPED HER BUILD A PEACEFUL FIVE-YEAR MARRIAGE

WOMAN REVEALS HOW PATIENCE AND TIMING HELPED HER BUILD A PEACEFUL FIVE-YEAR MARRIAGE

How N100m Was Mistakenly Paid Into Egbetokun’s Son’s Personal Account — FPRO

How N100m Was Mistakenly Paid Into Egbetokun’s Son’s Personal Account — FPRO

RCCG PASTOR ANGRY OVER CALLING Him“MR” INSTEAD OF “DR,” DECLARES CURSE ONLINE

RCCG PASTOR ANGRY OVER CALLING Him“MR” INSTEAD OF “DR,” DECLARES CURSE ONLINE

NPMA Appeals to Nigerian Government for Compensation After Lagos Market Fire

NPMA Appeals to Nigerian Government for Compensation After Lagos Market Fire

Rest Every Four Hours, FRSC Issues Safety Guide for Fasting Motorists

Rest Every Four Hours, FRSC Issues Safety Guide for Fasting Motorists

NNPC Boss Ojulari Bags UK Energy Institute Fellowship

NNPC Boss Ojulari Bags UK Energy Institute Fellowship

Shock in Anambra: Bride Disappears Moments Before Wedding

Shock in Anambra: Bride Disappears Moments Before Wedding

Nigerian Woman Returns ₦330 Million Accidentally Credited to Her Account

Nigerian Woman Returns ₦330 Million Accidentally Credited to Her Account

APC Don Reach Morocco?’ VeryDarkMan Reacts to Seyi Tinubu Poster

APC Don Reach Morocco?’ VeryDarkMan Reacts to Seyi Tinubu Poster

Bride Breaks Down in Tears as Wedding Meals Were Kept Secretly While Guests Go Home Hungry

Bride Breaks Down in Tears as Wedding Meals Were Kept Secretly While Guests Go Home Hungry

Share this post with your friends on ![]()