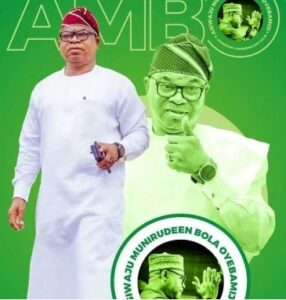

Before You Talk, Know the Facts About AMBO,The Man Who Fixed Osun’s Finances Without Borrowing a Kobo

Before You Talk, Know the Facts About AMBO,The Man Who Fixed Osun’s Finances Without Borrowing a Kobo

Some people need a reality check.

Before Bola Oyebamiji stepped into public service, he built a solid career in Nigeria’s banking sector—starting at WEMA Bank, then moving to Trans International Bank, Spring Bank, and finally Enterprise Bank. At Enterprise Bank, he rose to become Head of Retail Business, overseeing a key department in a financial institution that held over $1.6 billion (about N261 billion then) in assets. For the record, Enterprise Bank didn’t fall from the sky—it was the product of a strategic merger involving Trans International Bank and Spring Bank. Oyebamiji’s career moved in tandem with the evolution of the banking industry itself.

In 2012, he was appointed MD of Osun State Investment Company Limited (OSICOL), where he applied his financial expertise to public investment. Fast forward to 2017, he was named Commissioner for Finance in Osun State—not during the crisis, but nearly two years after the modulated salary policy was in place.

And what happened under his watch?

Within months, Osun was back to full salary payments. No new borrowing. In fact, N97 billion of inherited debt was paid off by the time he left office in 2022. That’s leadership backed by results—not slogans or gimmicks.

So before anyone throws stones, let them tell us—what exactly did your governor, Ademola Adeleke, achieve at “Origin International Perfume” or whatever glossy titles he’s claimed?

Leadership is not about drama or dance. It’s about record, responsibility, and results. Bola Oyebamiji—AMBO—has shown he’s got what it takes.

Let’s support great substance.Let’s support Bola Oyebamiji, let’s support AMBO for Osun State Governor.

TRENDING SONGS

NNPC Boss Ojulari Bags UK Energy Institute Fellowship

NNPC Boss Ojulari Bags UK Energy Institute Fellowship

Shock in Anambra: Bride Disappears Moments Before Wedding

Shock in Anambra: Bride Disappears Moments Before Wedding

Nigerian Woman Returns ₦330 Million Accidentally Credited to Her Account

Nigerian Woman Returns ₦330 Million Accidentally Credited to Her Account

APC Don Reach Morocco?’ VeryDarkMan Reacts to Seyi Tinubu Poster

APC Don Reach Morocco?’ VeryDarkMan Reacts to Seyi Tinubu Poster

Bride Breaks Down in Tears as Wedding Meals Were Kept Secretly While Guests Go Home Hungry

Bride Breaks Down in Tears as Wedding Meals Were Kept Secretly While Guests Go Home Hungry

Odogwu by Day, Robber by Night: How Marriage Joy Turned Into Tragedy

Odogwu by Day, Robber by Night: How Marriage Joy Turned Into Tragedy

Nigerian Officials Allegedly Pocket N4–6B Weekly Through Smuggling Cartels at Seme–Badagry Border

Nigerian Officials Allegedly Pocket N4–6B Weekly Through Smuggling Cartels at Seme–Badagry Border

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Share this post with your friends on ![]()