Tinubu’s Plan: New Agency to Take Over Revenue Collection from Customs and Others; See Details

Tinubu’s Plan: New Agency to Take Over Revenue Collection from Customs and Others; See Details

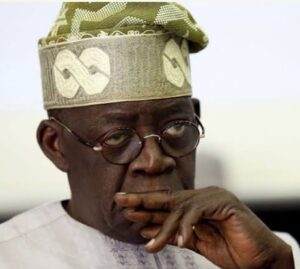

President Bola Tinubu is considering a significant shift in how revenue is collected in Nigeria, potentially excluding various agencies from this responsibility. His plan involves establishing a new entity—the Nigeria Revenue Service—to centralize revenue collection for the Federal Government.

This initiative coincides with the introduction of comprehensive tax reforms aimed at improving revenue generation. The reforms will restrict the Nigerian Customs Service, Nigerian Ports Authority, and over 60 other agencies from collecting revenue, instead assigning these duties to the proposed Nigeria Revenue Service.

The government’s objective is to streamline the tax collection process, ensuring equitable contributions from all taxable entities to enhance funding for public services and infrastructure projects.

On Thursday, President Tinubu submitted four executive bills to the National Assembly to facilitate these tax reforms. The country aims to increase its tax-to-GDP ratio to a minimum of 18 percent, as it currently ranks among the lowest in Africa and globally. This shortfall has contributed to fiscal deficits and an over-reliance on borrowing for public expenditures.

One of the proposed changes is to rename the Federal Inland Revenue Service (FIRS) to the Nigeria Revenue Service. However, sources within the presidency clarified that this would not result in a merger of agencies but would simply transfer the revenue collection responsibilities to the new service, allowing existing agencies to focus on their primary functions.

The bills presented in the National Assembly include the Nigeria Revenue Service (Establishment) Bill, aimed at repealing the existing FIRS Act and establishing the new agency. Other proposals involve creating a Tax Tribunal and a Tax Ombudsman to enhance dispute resolution and coordination in revenue administration.

Tinubu emphasized that the reforms would promote taxpayer compliance, strengthen fiscal institutions, and establish a more transparent and efficient fiscal framework.

Critics have expressed concerns regarding the feasibility of this plan. Dr. Eugene Nweke, a former president of the National Association of Government Approved Freight Forwarders, argued that customs agencies worldwide are traditionally responsible for revenue collection and that outsourcing this function could complicate matters.

Taiwo Fatobilola, National Public Relations Officer of the Association of Registered Freight Forwarders of Nigeria, echoed these concerns, highlighting the technical expertise required for effective revenue collection.

In contrast, Abdullahi Maiwada, National Public Relations Officer of the Nigeria Customs Service, stated he was unaware of the proposed changes.

TRENDING SONGS

WOMAN REVEALS HOW PATIENCE AND TIMING HELPED HER BUILD A PEACEFUL FIVE-YEAR MARRIAGE

WOMAN REVEALS HOW PATIENCE AND TIMING HELPED HER BUILD A PEACEFUL FIVE-YEAR MARRIAGE

How N100m Was Mistakenly Paid Into Egbetokun’s Son’s Personal Account — FPRO

How N100m Was Mistakenly Paid Into Egbetokun’s Son’s Personal Account — FPRO

RCCG PASTOR ANGRY OVER CALLING Him“MR” INSTEAD OF “DR,” DECLARES CURSE ONLINE

RCCG PASTOR ANGRY OVER CALLING Him“MR” INSTEAD OF “DR,” DECLARES CURSE ONLINE

NPMA Appeals to Nigerian Government for Compensation After Lagos Market Fire

NPMA Appeals to Nigerian Government for Compensation After Lagos Market Fire

Rest Every Four Hours, FRSC Issues Safety Guide for Fasting Motorists

Rest Every Four Hours, FRSC Issues Safety Guide for Fasting Motorists

NNPC Boss Ojulari Bags UK Energy Institute Fellowship

NNPC Boss Ojulari Bags UK Energy Institute Fellowship

Shock in Anambra: Bride Disappears Moments Before Wedding

Shock in Anambra: Bride Disappears Moments Before Wedding

Nigerian Woman Returns ₦330 Million Accidentally Credited to Her Account

Nigerian Woman Returns ₦330 Million Accidentally Credited to Her Account

APC Don Reach Morocco?’ VeryDarkMan Reacts to Seyi Tinubu Poster

APC Don Reach Morocco?’ VeryDarkMan Reacts to Seyi Tinubu Poster

Bride Breaks Down in Tears as Wedding Meals Were Kept Secretly While Guests Go Home Hungry

Bride Breaks Down in Tears as Wedding Meals Were Kept Secretly While Guests Go Home Hungry

Share this post with your friends on ![]()