Fiscal Crisis Deepens: Tinubu’s Borrowing Surpasses Buhari’s by Tenfold

Fiscal Crisis Deepens: Tinubu’s Borrowing Surpasses Buhari’s by Tenfold

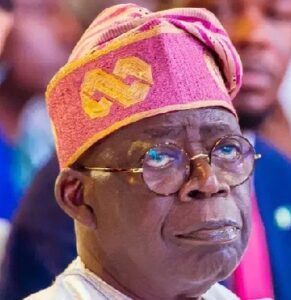

President Bola Ahmed Tinubu

The African Democratic Congress (ADC) has voiced strong condemnation of what it terms “fiscal recklessness” by President Tinubu’s administration following the National Assembly’s recent approval of an additional $21 billion in foreign loans.

According to the party, this surge in borrowing is set to push Nigeria’s public debt past the ₦200 trillion mark before the year ends — all without any tangible economic growth or infrastructure improvements to justify such an enormous financial burden.

In a statement issued by its National Publicity Secretary, Mallam Bolaji Abdullahi, the ADC accused President Tinubu of dramatically escalating the nation’s debt levels, far exceeding the amount borrowed under former President Buhari, effectively mortgaging the country’s future under the guise of reform.

The party also criticized the National Assembly for failing in its oversight role, describing lawmakers as mere rubber stamps who have neglected their responsibility to safeguard Nigerians from the dangers of unsustainable debt accumulation.

The ADC expressed deep concern over the current administration’s relentless borrowing spree. They argued that approving yet another $21 billion loan is a deliberate move to mask current governance failures by saddling future generations with debilitating debt.

“During Buhari’s tenure, Nigeria borrowed an average of N4.7 trillion annually — a figure that already raised alarms. Yet, under Tinubu, annual borrowing has skyrocketed to nearly N50 trillion. In just two years, this administration has taken on more debt than Buhari did in a decade. At this pace, Nigeria’s total public debt is on course to surpass ₦200 trillion before year-end. We are hurtling toward a fiscal disaster, with no sign of restraint or strategic financial planning,” the statement said.

The ADC also debunked claims that Tinubu’s borrowing is smaller in dollar terms compared to Buhari’s. They highlighted that the sharp depreciation of the naira under Tinubu means foreign loans now translate to significantly higher costs when converted to local currency.

“While supporters argue that Tinubu’s annual foreign borrowing of $1.7 billion is less than Buhari’s $4.15 billion, this fails to account for exchange rate realities. With the naira plunging, these loans now equate to N25.5 trillion annually — over ten times Buhari’s average in naira terms. This is a clear indicator of worsening debt mismanagement compounded by a collapsing currency,” the party added.

Since the APC assumed power in 2015, Nigeria’s public debt has surged from N12.6 trillion to over N149 trillion. External borrowing alone has topped $35 billion in the past decade, representing a nearly twelvefold increase. The country’s debts to international institutions like the World Bank have tripled, and Eurobond liabilities have grown elevenfold. Now, with plans to raise the foreign debt ceiling to $67 billion, the ADC warned that Nigeria risks being trapped in a debt cycle that jeopardizes future generations.

The opposition further pointed out that despite soaring debts, critical sectors like education, healthcare, infrastructure, and power remain underdeveloped. They questioned the purpose of these loans and urged the National Assembly to scrutinize borrowing decisions more rigorously.

“The burden of Tinubu’s borrowing is already strangling our economy. Small businesses struggle to access credit, investor confidence is waning, and over 60% of national revenue is allocated to debt servicing. This leaves ordinary Nigerians overtaxed and economically squeezed,” the statement said.

In contrast to other countries working to reduce debt, the ADC accused the APC government of increasing borrowing, even after the recent naira devaluation, which should have reduced the need for external funds.

The party demanded transparency on all loans acquired in the last ten years, insisting Nigerians deserve to know the terms, interest rates, repayment schedules, and beneficiaries of the funds.

TRENDING SONGS

Shock in Anambra: Bride Disappears Moments Before Wedding

Shock in Anambra: Bride Disappears Moments Before Wedding

Nigerian Woman Returns ₦330 Million Accidentally Credited to Her Account

Nigerian Woman Returns ₦330 Million Accidentally Credited to Her Account

APC Don Reach Morocco?’ VeryDarkMan Reacts to Seyi Tinubu Poster

APC Don Reach Morocco?’ VeryDarkMan Reacts to Seyi Tinubu Poster

Bride Breaks Down in Tears as Wedding Meals Were Kept Secretly While Guests Go Home Hungry

Bride Breaks Down in Tears as Wedding Meals Were Kept Secretly While Guests Go Home Hungry

Odogwu by Day, Robber by Night: How Marriage Joy Turned Into Tragedy

Odogwu by Day, Robber by Night: How Marriage Joy Turned Into Tragedy

Nigerian Officials Allegedly Pocket N4–6B Weekly Through Smuggling Cartels at Seme–Badagry Border

Nigerian Officials Allegedly Pocket N4–6B Weekly Through Smuggling Cartels at Seme–Badagry Border

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Share this post with your friends on ![]()