“Pay Us While We’re Alive!” – Pensioners Urge Federal Government

“Pay Us While We’re Alive!” – Pensioners Urge Federal Government

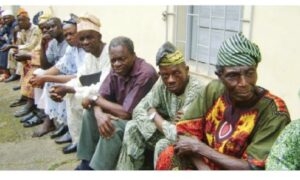

Numerous pensioners are urgently appealing to the Federal Government and their Pension Fund Administrators (PFAs) for prompt payment of their pensions and annuity entitlements while they are still living.

In interviews with NAN on Sunday, these retirees highlighted their pressing financial needs for essentials such as food, medical care, and other living expenses.

Ekpemyong Francis, who retired from the Federal Ministry of Information and Culture in May 2023, expressed frustration at not having received his retirement benefits. “We are still waiting for the Federal Government to release the accrued rights to my PFA for my pension calculation,” he said. “My family is struggling to eat. I can’t pay my children’s school fees, my landlord is demanding rent, and I can’t access the National Health Insurance Scheme (NHIS). I need immediate medical attention.”

Joy Izor, who retired from the Ministry of Defence in 2016, shared her difficulties with a low pension. “My PFA is IBTC, and they calculated my monthly pension at N20,000. I switched to an annuity that promised N25,000, but I haven’t received any extra funds. We are barely getting by; I even opened a shop to sell soft drinks, but it was demolished by the government. That amount doesn’t cover my family’s needs or medical expenses,” she lamented.

Grace Yussuf, a former Deputy Editor-in-Chief at NAN, echoed these concerns, revealing that she has not received any payments since her retirement in May 2023. “My NHIS coverage ended right after I retired, leaving me with heavy medical costs for lab tests and medications. The expense of registering for a private NHIS is overwhelming,” she noted.

Others, like Mrs. Nkiru Osisioma and Mrs. Christiana Ubah, also raised alarms about their pensions, with Ubah stating she hasn’t been paid in six months. “I can’t afford to feed myself. Some of us retired in March 2023 and have yet to receive any payments. The economic situation is dire due to our leaders,” Ubah added.

Legal expert Emmanuel Ikenna emphasized the importance of effective pension management for national development and suggested that the Pension Reform Act needs regular reviews. “Pension is a critical payment made by the state to individuals at or above retirement age, essential for their well-being,” he said.

An official from the National Pension Commission (PenCom) addressed some misunderstandings regarding lump-sum withdrawals from retirees’ Retirement Savings Accounts (RSAs). They clarified that retirees are permitted to withdraw a portion of their pension savings upon retirement, based on a standardized calculation template provided by PenCom.

The official also mentioned ongoing efforts to resolve payment issues for annuitants under African Alliance Insurance Company, stating that PenCom is working with the National Insurance Commission (NAICOM) to ensure affected retirees receive their benefits.

TRENDING SONGS

Nigerian Officials Allegedly Pocket N4–6B Weekly Through Smuggling Cartels at Seme–Badagry Border

Nigerian Officials Allegedly Pocket N4–6B Weekly Through Smuggling Cartels at Seme–Badagry Border

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Share this post with your friends on ![]()