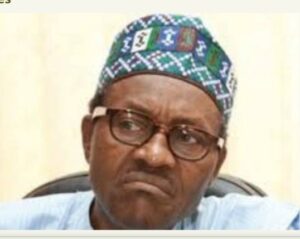

World Bank Report: Buhari’s Policies Reverse Nigeria’s Economic Progress

World Bank Report: Buhari’s Policies Reverse Nigeria’s Economic Progress

A recent World Bank report highlights that Nigeria experienced a significant economic decline from 2015 to 2022, reversing gains achieved during the administrations of Olusegun Obasanjo, Umaru Yar’Adua, and Goodluck Jonathan between 1999 and mid-2015.

The World Bank’s Nigeria Development Update (NDU), titled “Staying the Course: Progress Amid Pressing Challenges,” outlines how inconsistent policies and a shrinking oil sector led to a one-third decrease in GDP per capita during this period.

According to the report, “Income gains from 2000-2014 were largely undone from 2015 onward. The decline in GDP per capita resulted from erratic macroeconomic policies, a struggling oil sector, and external shocks, while other nations continued to progress.”

The analysis indicates that unconventional monetary and foreign exchange policies significantly contributed to rising inflation. The Central Bank of Nigeria (CBN) enforced strict foreign exchange management alongside loose monetary policies, which exacerbated inflation and the disparity between official and parallel market exchange rates.

The report further noted that fiscal deficits widened under Muhammadu Buhari, with increased reliance on CBN financing leading to mounting debt pressures.

While acknowledging the economic hardships resulting from President Bola Tinubu’s reforms, the Bank observed early signs of recovery. It stated, “Significant policy reforms are beginning to yield positive outcomes. Despite substantial adjustments, GDP growth remains resilient, driven by the services sector, with a slight increase in early 2024.”

The report also recognized progress in foreign exchange reforms, noting a more market-aligned exchange rate and an increase in foreign reserves to nearly $39 billion, alongside a significant rise in foreign exchange turnover.

The CBN has prioritized price stability and implemented a tighter monetary policy, raising the Monetary Policy Rate (MPR) by 850 basis points since February 2024. Additionally, the bank has standardized the cash reserve ratio and reduced reliance on development finance loans.

As fiscal consolidation efforts progress, the report noted a reduction in the government’s fiscal deficit due to increased revenues and controlled spending. Contrary to the belief that fuel subsidies dominate government expenditures, the report indicates there’s still work ahead.

It urged the Tinubu administration to maintain a unified, market-responsive exchange rate and to clarify foreign exchange intervention strategies to improve market transparency. The report emphasized the need for maintaining a market-reflective petrol price and ensuring that subsidy removal benefits the economy.

Furthermore, it called for bolstering non-oil revenue sources, reforming the value-added tax system, and enhancing tax administration through measures like e-invoicing and improved tax audits. Targeted support for vulnerable households is also essential amid ongoing inflation, which remains high at 32.7% year-on-year as of September 2024.

While acknowledging a slight decrease in inflation, the World Bank noted that the economic landscape remains challenging. The increase in poverty levels can be attributed to inflation, slow growth, and past economic missteps, with recent corrections exacerbating the situation.

The report highlighted the government’s cash transfer program, which aims to assist 15 million households (over 60 million individuals) with direct payments. However, low registration rates for the National Identification Number and Bank Verification Number have hindered the program’s rollout.

Lastly, the World Bank pointed out that the newly set minimum wage of N70,000 may not significantly impact most Nigerians, as only a small percentage of the working population stands to benefit. The challenge remains to create sufficient productive jobs, as high employment rates alone do not guarantee a reduction in poverty.

TRENDING SONGS

NPMA Appeals to Nigerian Government for Compensation After Lagos Market Fire

NPMA Appeals to Nigerian Government for Compensation After Lagos Market Fire

Rest Every Four Hours, FRSC Issues Safety Guide for Fasting Motorists

Rest Every Four Hours, FRSC Issues Safety Guide for Fasting Motorists

NNPC Boss Ojulari Bags UK Energy Institute Fellowship

NNPC Boss Ojulari Bags UK Energy Institute Fellowship

Shock in Anambra: Bride Disappears Moments Before Wedding

Shock in Anambra: Bride Disappears Moments Before Wedding

Nigerian Woman Returns ₦330 Million Accidentally Credited to Her Account

Nigerian Woman Returns ₦330 Million Accidentally Credited to Her Account

APC Don Reach Morocco?’ VeryDarkMan Reacts to Seyi Tinubu Poster

APC Don Reach Morocco?’ VeryDarkMan Reacts to Seyi Tinubu Poster

Bride Breaks Down in Tears as Wedding Meals Were Kept Secretly While Guests Go Home Hungry

Bride Breaks Down in Tears as Wedding Meals Were Kept Secretly While Guests Go Home Hungry

Odogwu by Day, Robber by Night: How Marriage Joy Turned Into Tragedy

Odogwu by Day, Robber by Night: How Marriage Joy Turned Into Tragedy

Nigerian Officials Allegedly Pocket N4–6B Weekly Through Smuggling Cartels at Seme–Badagry Border

Nigerian Officials Allegedly Pocket N4–6B Weekly Through Smuggling Cartels at Seme–Badagry Border

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Share this post with your friends on ![]()